This latest budgetary revision reflects the ongoing challenges facing South Africa as it attempts to navigate a complex economic landscape and address the pressing issues of fiscal sustainability and growth. As the government grapples with internal disagreements and external pressures, the road ahead remains fraught with uncertainty for South Africa’s economic future.

In a striking reversal, South Africa’s National Treasury announced on Wednesday that the country’s budget deficit is set to widen, alongside increased public debt levels. This adjustment follows the government’s decision to abandon a planned increase in value-added tax (VAT), further complicating the nation’s fiscal landscape.

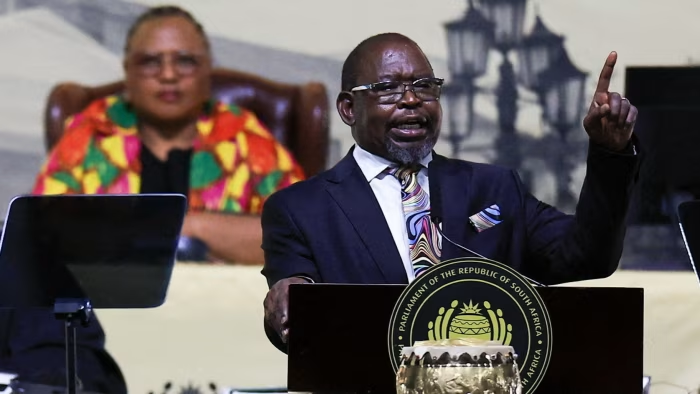

The announcement came during the presentation of the revised 2025 budget, which marks the third attempt to secure a comprehensive fiscal strategy amidst persistent disagreements within South Africa’s coalition government. The failure to raise VAT, combined with lowered economic growth projections, has prompted the Treasury to slash its medium-term tax revenue forecasts by a staggering 61.9 billion rand ($3.5 billion).

Officials now anticipate a consolidated budget deficit of 4.8% of gross domestic product (GDP) for the current fiscal year, worsening from the 4.6% projected in the previous budget iteration released in March. Additionally, gross public debt is forecasted to stabilise at 77.4% of GDP in the 2025/26 fiscal year, exceeding the previous projection of 76.2%.

Since the 2008-2009 global financial crisis, South Africa—the continent’s largest economy—has grappled with sluggish growth rates that have hindered meaningful progress in addressing high inequality and rampant unemployment. Over the years, public debt has risen sharply as the government has struggled to control excessive spending, resulting in repeated credit rating downgrades that have stymied economic recovery.

Now, the Treasury predicts the economy to expand by just 1.4% this year, a decline from the previously estimated growth rate of 1.9%. In response to this grim outlook, consolidated government spending has been revised downward by 69.4 billion rand over a three-year timeline.

In a related development, Fundi Tshazibana, a deputy governor of South Africa’s central bank, indicated at a press conference that policymakers are not yet prepared to adjust the nation’s inflation target, which currently sits within a range of 3% to 6%. There had been speculation in the market regarding a potential shift in the inflation target, which had, in recent days, bolstered the rand as traders anticipated supportive changes in the budget following remarks made by a deputy finance minister at an investment conference.