Finance Minister Enoch Godongwana said the Treasury has no choice but to borrow into foreign exchange accounts to reduce the high debt service costs.

This will see the introduction of a new reform of the Gold and Foreign Exchange Contingency Reserve Account (GFECRA).

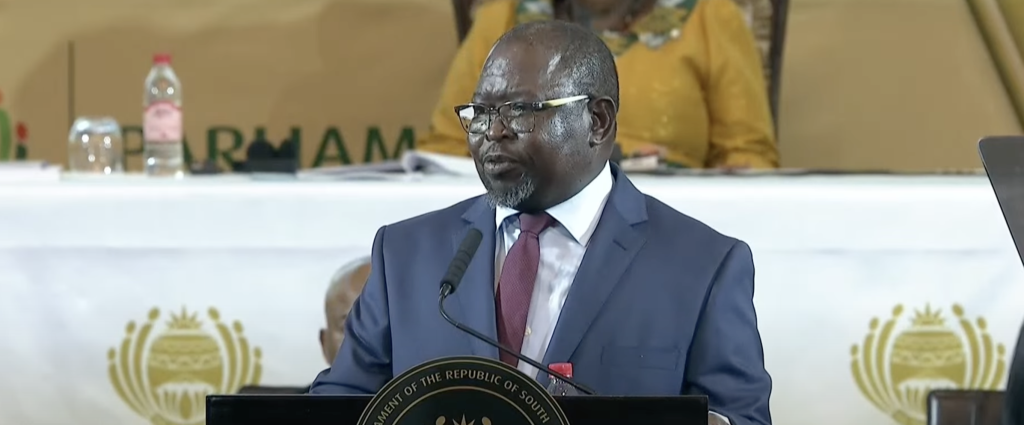

Godongwana announced this when he was tabling the 2024 Budget Speech held at the Cape Town City Hall on Wednesday.

According to Godongwana, this will mitigate the fiscal risks by reducing government borrowing and allow it to draw down from its GFECRA held at the Reserve Bank.

“We will draw down R150 billion of the GFECRA balance once we have ensured that sufficient buffers are available to absorb exchange rate swings and the solvency of the Reserve Bank is not compromised,” said Godongwana.

Compared to a year ago, the budget deficit for 2023/24 is estimated to worsen from 4 per cent to 4.9 percent of GDP.

According to the Minister, the higher budget deficit means that debt-service costs in 2023/24 have been revised higher, by R15.7 billion to R356 billion.

Godongwana acknowledged that load shedding disrupts production, operations, and livelihoods.

He said it is through the combination of private investment in new energy projects, rooftop solar installations and improvements in Eskom’s generation fleet that load shedding will reduce, and reliability and security of supply improve.

“In addition, to support these efforts, we are introducing a new R2 billion conditional grant over the medium term to fund the rollout of smart prepaid meters,” added the Minister.

To address South Africa’s increasingly unreliable logistics system, the government has provided Transnet with a R47 billion guarantee facility to support the entity’s recovery plan and meet its immediate debt obligations.

Despite the hard economic atmosphere, the Minister didn’t spare the smokers and drinkers by increasing excise duties for alcohol and tobacco.

“A can of beer increases by 14 cents, a can of a cider and alcoholic fruit beverage goes up by 14 cents, a bottle of wine will cost an extra 28 cents, a bottle of fortified wine will cost an extra 47 cents, a bottle of sparkling wine will cost an extra 89 cents, and bottle of spirits, including whisky, gin, or vodka, increases by R5.53.

A R9.51 cents increase for cigars, 97 cents increase to a pack of cigarettes, an extra 57 cents for a pipe of tobacco and an increase of the excise duty on electronic nicotine and non-nicotine delivery systems, known as vapes to R3.04 per millilitre,” said the Minister.

Good news for nearly 19 million social grants beneficiaries, as the minister increased the grants to keep pace with inflation and increase access.

“An increase of R100 to the old age, war veterans, disability, and care dependency grants.

This amount will be divided into R90 effective from April, and R10 effective October.

A R50 increase to the foster care grant, and a R20 increase to the child support grant,” explained the Minister.

Godongwana however highlighted that work is underway to improve the R350 COVID-19 Social Relief of Distress Grant by April this year.

The contentious National Health Insurance Bill (NHI) also received a boost as the health sector received an allocation of R848 billion, with at least R1 billion directed to NHI.

“These allocations include R11.6 billion to address the 2023 wage agreement, R27.3 billion for infrastructure, and R1.4 billion for the NHI grant over the same period.

“The allocation for the NHI is a demonstration of the government’s commitment to this policy,” added the minister.