Bitcoin has managed to hold its ground above $67,000 (R1,173,699) following a market correction that saw its value surpass $69,000 — a level not seen since late July. According to Samer Hasn, a senior market analyst at XS.com, this recent dip has not deterred investors, who remain optimistic about leading cryptocurrencies amid a favourable backdrop of substantial inflows into crypto-investment products and heightened speculation surrounding the upcoming US presidential election.

In a striking development last week, cryptocurrency investment products experienced massive inflows of $2.2 billion, marking the highest level recorded since July. Bitcoin accounted for the majority of these inflows, with significant sums directed towards US spot exchange-traded funds (ETFs). SoSo Value reported that net flows to these funds reached over $294 million just yesterday, underscoring the growing interest in digital assets.

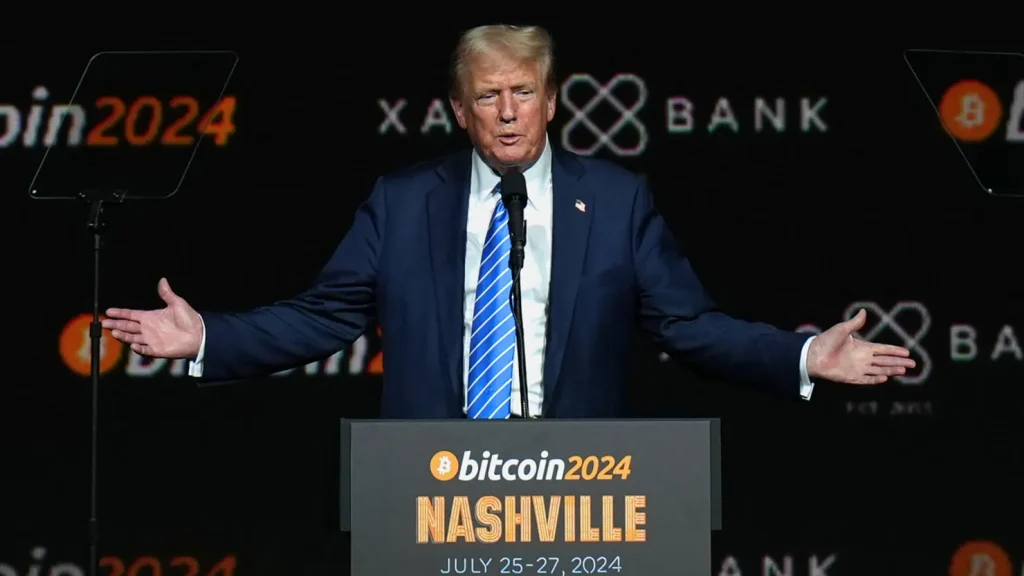

As the US presidential election looms with only two weeks remaining, market betting insights from Polymarket suggest a 63% probability of Republican candidate Donald Trump clinching victory. However, this has prompted controversy about the identities behind this surge in bets. Contrasting this is the poll average from FiveThirtyEight, which currently shows Democratic candidate Kamala Harris leading with 48.2% against Trump’s 46.4%, raising questions about the actual political landscape and implications for market sentiment.

Hasn explains that the ongoing fluctuations in polls and betting predictions may heighten cryptocurrencies’ exposure to unpredictable volatility in the days leading up to the election, suggesting that the final outcome could have major ramifications for the industry. The futures market itself, however, paints a mixed picture. Bitcoin futures open interest hit a record above $40 billion yesterday, according to CoinGlass, despite the recent price corrections.

Of this $40 billion, $12.5 billion is recorded on the Chicago Mercantile Exchange (CME), highlighting an unprecedented level of activity for Bitcoin futures on the largest US futures exchange. This increase is indicative of greater institutional investor participation in the cryptocurrency market, which has become a significant driver of price movements.

Yet, Hasn has raised red flags regarding a noticeable drop in the long/short ratio. It fell from 1.04 on Sunday to 0.94 today, revealing a growing number of bearish positions in the futures market. This trend could signal a potential reversal of Bitcoin’s bullish trajectory, suggesting that losses experienced yesterday might be on the verge of being revisited.